Medical debt in the United States is a pressing issue affecting millions of individuals. Despite the majority having health insurance, high deductibles and copayments still leave many burdened with medical debt. A recent analysis by the Kaiser Family Foundation reveals alarming statistics:

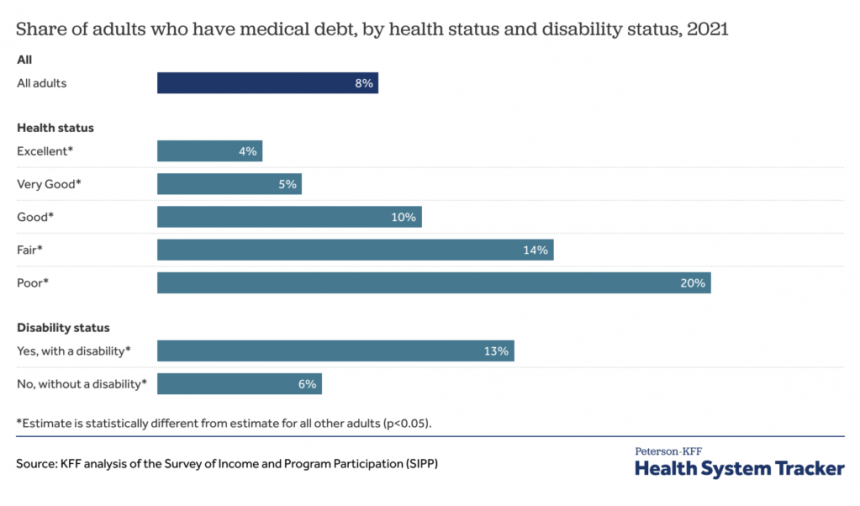

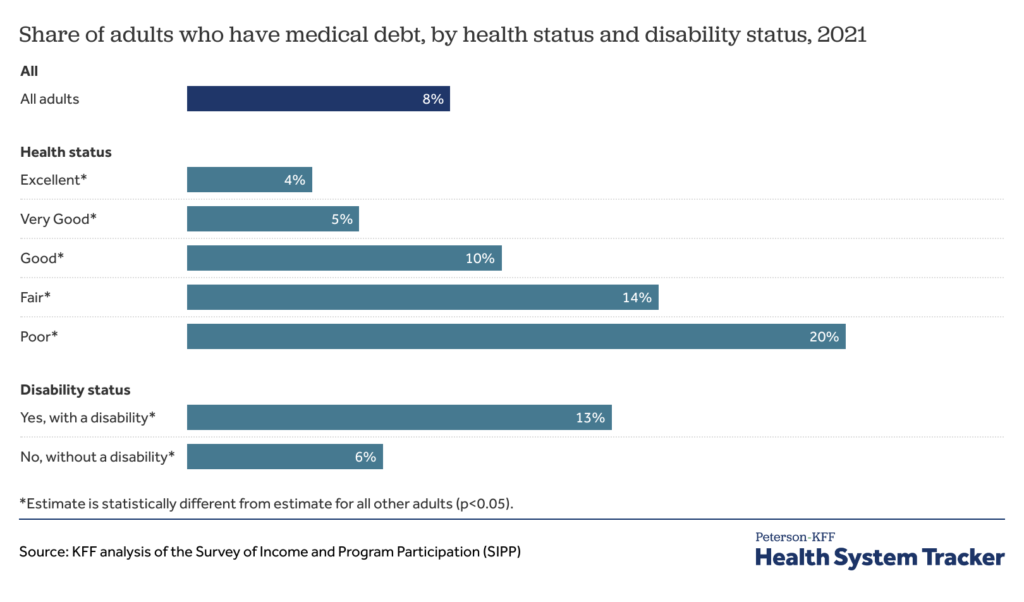

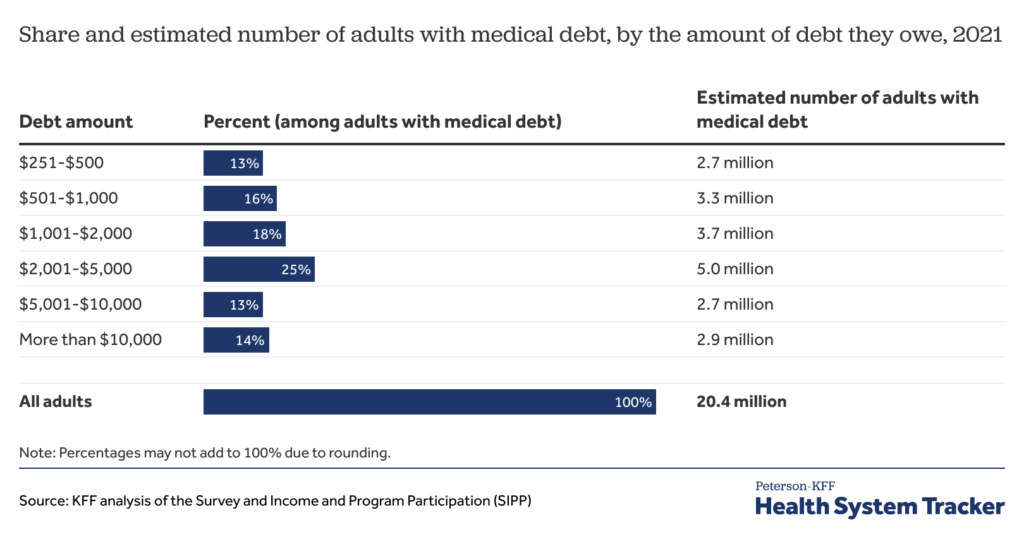

Approximately 20 million adults (1 in 12) in the U.S. owe medical debt, totaling over $220 billion. Of these, 14 million owe more than $1,000 and 3 million owe over $10,000. The burden of medical debt is seen across various demographics, with higher prevalence among those with disabilities, lower-income individuals, and the uninsured.

Given the substantial impact of medical debt, a crucial question arises: what would be the consequences if this debt were eliminated? A study by Kluender et al. (2024) sheds light on this issue.

Research conducted in partnership with RIP Medical Debt involving 83,401 individuals who had $169 million of medical debt relieved between 2018 and 2020 showed interesting outcomes. The study found minimal changes overall, with no significant impact on credit access, utilization, or financial distress. However, a moderate decrease in payment of existing medical bills was observed. Moreover, the relief had no average effect on mental health, although certain groups experienced negative repercussions based on pre-registered analysis.

This surprising conclusion has been covered by The New York Times, highlighting the complexities surrounding medical debt relief.