Health insurance premiums in the U.S. are tax deductible if paid through out-of-pocket expenses, but out-of-pocket expenses themselves are not. However, there are exceptions to this rule, such as two tax-favored accounts:

- Flexible savings accounts (FSA): Allow employees to set aside pretax income for qualified medical expenses, but funds not used by year-end are forfeited.

- Health savings accounts (HSA): Allow pretax savings for medical expenses, with balances rolling over annually. Only employees with high-deductible health plans can contribute to HSAs.

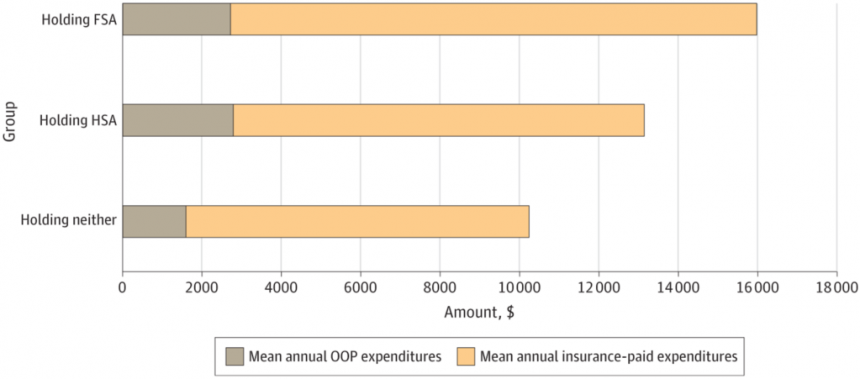

A study by Ding and Glied (2024) analyzed health care expenditure data from the Medical Expenditure Panel Survey (MEPS) to compare families with FSAs and HSAs to those without. Findings showed that families with FSAs spent 20% more annually on health care, largely due to higher insurer-paid expenses. Families with HSAs spent 44% more on out-of-pocket costs, with overall expenditures similar to non-account holders.

Additional tax expenditures associated with FSAs averaged $1306 annually per family.

The full paper can be accessed here.