This challenging question delves into the various world views on competition in the US:

Decline-in-competition perspective focuses on market concentration, markets decline, labor share decline, and new-business formation rate decrease at a macro level. On the other hand, Competition-in-action view considers how “superstar” firms delivering value through new technologies impact concentration and price/cost markups. The same empirical evidence can support different viewpoints.

Market concentration is a key factor with examples of concentration due to acquisitions raising concerns of market power, while internal growth by efficient firms improving products and prices may not be problematic. Market definitions can skew concentration measurement either up or down.

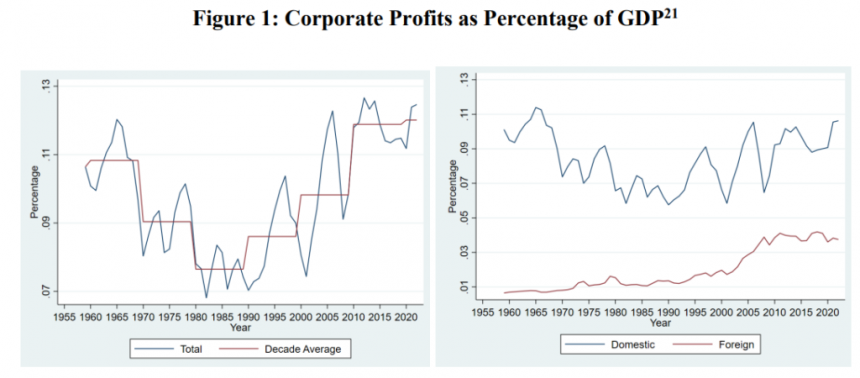

Price-markups indicate potential market power, but estimating them is challenging due to varying costs, sharing costs across products, and aggregating data. Corporate profits growing due to success in foreign markets is a key trend impacting market dynamics.

Approaches to estimating markups include the demand approach and production approach, with the latter being more common. Notably, recent literature and studies like those by Sutton and the Clayton Act provide insights into competition dynamics in the US.

For a detailed analysis of the current state of competition in the US, refer to papers by Carl Shapiro, Ali Yurukoglu, and Sutton. Understanding market concentration, price markups, and merger effects are crucial in assessing competition levels.