In Kahneman and Tversky’s Prospect Theory, loss aversion is a key concept. This refers to the tendency for individuals to feel the impact of losses more strongly than gains of the same magnitude. For example, losing a certain amount of money has a greater psychological effect than gaining the same amount. The question arises as to how much more intensely individuals experience gains than losses.

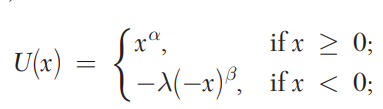

Formally, prospect theory assumes a utility function illustrated with the following parameters:

Previous estimates by Tversky and Kahneman in 1992 calculated loss aversion at λ=2.25, and α=β=0.88. A utility function with these parameters can be graphed as shown below.

A meta-analysis by Brown et al. (2024) delves into loss aversion estimates from various studies between 1992 and 2017. The results showed a median loss aversion of 1.69 and a mean of 1.97, with a refined estimate of 1.955. This value is supported by a range of 1.820 to 2.102 with 95% probability.

Comparing these findings to earlier studies, it is evident that the Brown et al. results are higher than some estimates but lower than the original Tversky and Kahneman figure. Further research and analysis are needed to refine our understanding of loss aversion.

For more information, please refer to the full paper here.

Key References

- Brown, Alexander L., Taisuke Imai, Ferdinand M. Vieider, and Colin F. Camerer. “Meta-analysis of empirical estimates of loss aversion.” Journal of Economic Literature 62, no. 2 (2024): 485-516.

- Neumann, Nico, and Ulf Böckenholt. 2014. “A Meta-Analysis of Loss Aversion in Product Choice.” Journal of Retailing 90 (2): 182–97.

- Tversky, Amos, and Daniel Kahneman. 1992. “Advances in Prospect Theory: Cumulative Representation of Uncertainty.” Journal of Risk and Uncertainty 5 (4): 297–323.

- Walasek, Lukasz, Timothy L. Mullett, and Neil Stewart. 2018. “A Meta-Analysis of Loss Aversion in Risky Contexts.” http://dx.doi.org/10.2139/ssrn.3189088.