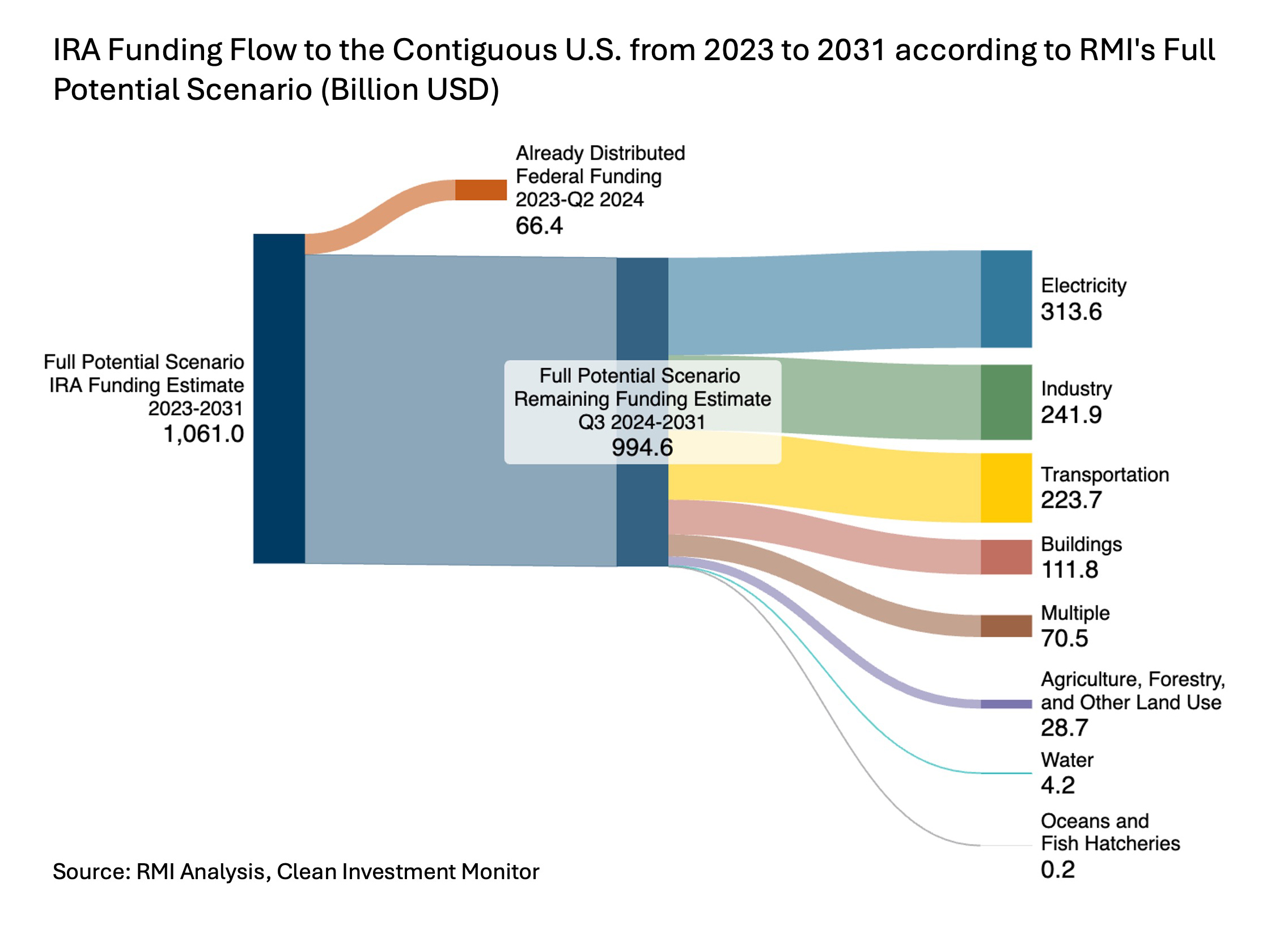

Two years ago, President Joe Biden signed the Inflation Reduction Act (IRA) into law, signaling the start of a race for states to attract private investments and capitalize on tax incentives to boost their clean energy economies. However, a report from the Rocky Mountain Institute (RMI) suggests that progress has been slow. The report indicates that the federal government needs to invest around $1 trillion by 2031 to meet clean energy goals, but only $66 billion has been distributed through June 2024, representing just 6% of the required spending.

The RMI report reveals that private investments in clean energy have matched and multiplied the $66 billion federal spending by five-fold. While the IRA tax credits have no annual limit, states have received tax benefits based on private clean energy investments in their economies. Some leading states like California and Texas have claimed significant tax benefits, but most states are far from reaching their full funding potential by 2031.

Rocky Mountain Institute / Clean Investment Monitor

The RMI report highlights the varying levels of federal funding captured by states relative to their full potential. While California and Texas lead in tax benefits received, many states are below 7% of their funding targets for 2031. To address this issue, states can implement policies to boost clean tech demand, offer guidance on navigating incentives, and engage stakeholders in key sectors to maximize benefits.

While individual households are exceeding predictions in utilizing tax credits, overall funding progress lags. The report emphasizes the importance of states identifying opportunities for clean energy adoption and investment to fully leverage available incentives. Initiatives like South Carolina’s Special Committee on Energy Future serve as examples of states proactively organizing to maximize federal funding potential.